🚨 EstateX Impresses Global Elite at $3 Trillion Investment Summit 🚨

🚨 EstateX Captivates $3 Trillion Audience at Global Family Office Summit—What This Means for the Future of Real Estate Investment 🚨

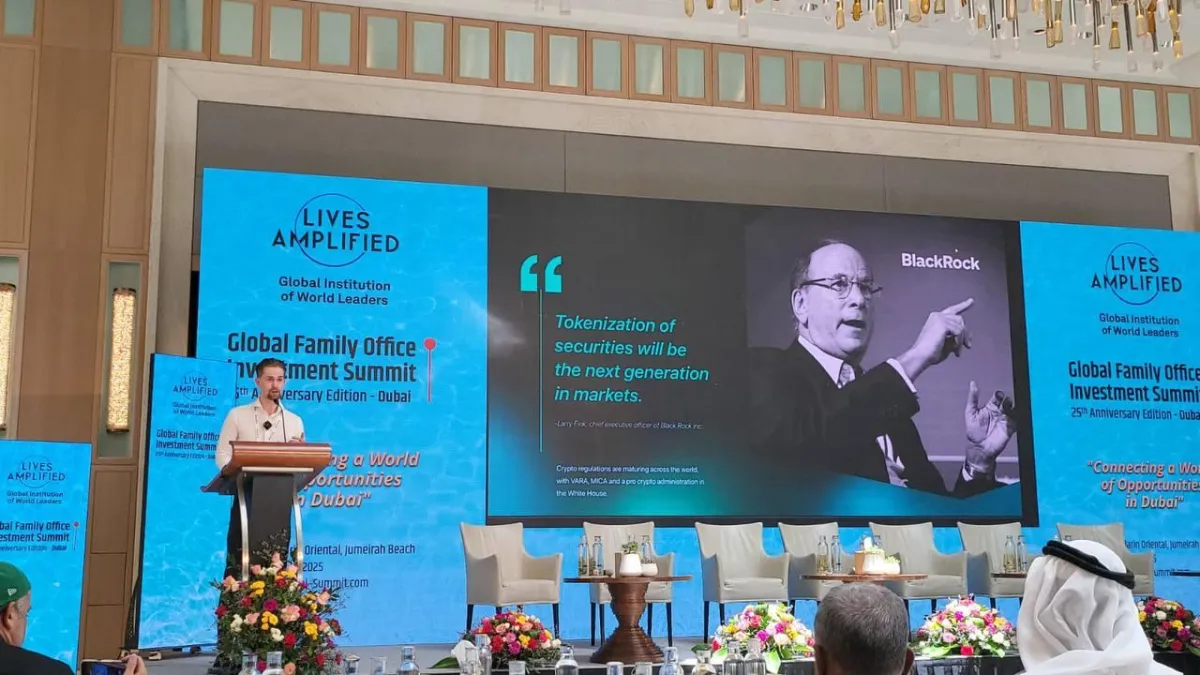

DUBAI, UAE | EstateX Newsroom – Last week, EstateX stepped into one of the most exclusive arenas in the world of private capital: the Global Family Office Investment Summit (GFOIS). With over $3 trillion in represented wealth, the event gathered royalty, politicians, tech billionaires, major funds, and high-net-worth individuals (HNWIs) under one roof to explore the next frontier of global investment.

And it was here that EstateX delivered one of its most pivotal pitches to date.

🚀 A Monumental Milestone in the EstateX Journey

With the EstateX platform preparing for its highly anticipated launch, the GFOIS appearance couldn’t have come at a better time. The EstateX team used this elite stage to unveil the project’s vision, ecosystem, and cutting-edge suite of products that aim to democratize and digitize access to the global real estate market.

Among the highlights shared:

A fully developed and compliant investment platform

A dual-token economy ($ESX and PROPX)

The industry’s first real estate-backed debit card

Permissionless lending against tokenized property

A growing, engaged community with over 121,000 users

Major partnerships with Microsoft, GDA Capital, and the co-founder of USDT

The audience’s reaction? Electric. Conversations with influential investors, institutional funds, and even sovereign actors confirmed what the team already knew—EstateX is solving a trillion-dollar problem with elegant, real-world solutions.

🌍 Why This Matters: Real Impact on the EstateX Ecosystem

The buzz and validation from GFOIS are not just symbolic—they’re strategically transformative. Here's how this success fuels EstateX's ecosystem and mission:

1. Increased Institutional Access & Exposure

By pitching directly to major family offices, private equity leaders, and policy influencers, EstateX opens doors to capital, real estate assets, and regulatory alignment that would otherwise take years to develop. This accelerates:

Asset onboarding for tokenization via TokenizeX

Liquidity partners for CapitalX loans

Listings and liquidity provisioning for PropXchange

Cross-border expansion into new real estate markets

2. Stronger Token Utility & Ecosystem Growth

Interest from large investors in using EstateX services directly translates into more volume, more token flow, and more utility for $ESX, the ecosystem’s payment and utility token.

Increased transaction volume means higher demand for $ESX (used for fees)

More property tokenizations add liquidity to the PropXchange

Loan usage via CapitalX requires token collateral and interaction with the protocol

EstateX Pay adoption by influencers and institutions means more real-world ESX spending

All of this creates buy pressure, token velocity, and ultimately price support for $ESX.

3. Validation From Elite Circles

In Web3 and real estate, reputation is everything. Being invited to—and making an impact at—GFOIS puts EstateX in the same category as projects backed by:

Billion-dollar real estate portfolios

Tech giants like Microsoft

Advisors like Brock Pierce (USDT & EOS co-founder) and Brian D. Evans

This enhances brand credibility, attracts high-quality partnerships, and encourages new investor segments—especially institutions wary of the usual crypto hype.

4. Content & Awareness Campaigns

The team documented this milestone extensively and will be releasing footage, interviews, and behind-the-scenes content in the coming weeks. These moments are more than PR—they’re narrative fuel.

Expect:

High-conversion video content for investor onboarding

Educational clips explaining tokenization to mass audiences

Social proof that EstateX is already being embraced by the global elite

This content strategy plays a huge role in converting curious Web2 users into confident Web3 investors.

💡 The Bigger Picture: Web3 Real Estate Goes Global

The Summit marks a clear transition: EstateX is no longer just a disruptive idea—it's becoming a global player. This level of visibility pushes forward EstateX’s long-term vision of:

Democratizing real estate ownership

Bringing liquidity to one of the world’s most illiquid asset classes

Helping people around the world build passive income with as little as $100

This mission is made possible by the EstateX ecosystem, which includes:

Product Benefit TokenizeX Tokenize any property for fractional sale—compliant and easy. CapitalX Get instant, collateral-free loans against tokenized real estate. PropXchange Trade your property tokens on a liquid secondary market. EstateX Pay Use your property-backed portfolio to pay for goods and services. EstateX University Learn how to grow wealth through financial literacy & smart investing.

With these tools, EstateX empowers users at every level—from Gen Z renters to institutional giants.

📈 What to Watch Next

The momentum from GFOIS is just beginning. In the coming weeks, you’ll see:

Exclusive content drops from the summit floor

New partnership announcements

Real estate asset onboarding from global influencers and family offices

Major media features highlighting EstateX’s role in the future of tokenized real-world assets (RWA)

If this summit is any indication, the world’s most powerful investors are not just watching EstateX—they’re getting involved.

🔗 Stay Connected With EstateX

To witness the transformation of real estate finance in real time:

📺 YouTube

✍️ Medium Blog

This is a defining chapter in the EstateX story—and you’re here for it.

Join the revolution. Build your future.

⚠️ Disclaimer

This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice. The EstateX platform and its associated tokens ($ESX and PROPX) involve risk, and past performance is not indicative of future results. All investments carry inherent risks, including the potential loss of capital. Users should conduct their own due diligence and consult with a licensed financial advisor before making investment decisions. EstateX operates within the regulatory frameworks of the jurisdictions in which it is licensed. Availability of products and services may vary by region.